Case Study: Discover Financial Services, USA

Simplified transformation for a #TrulyDigital banking

Carlos Minetti, President of Consumer Banking at Discover Financial Services

Discover's adoption of the Finacle solution is part of our continuous commitment to improve our customer experience. As our direct banking business grows, the Finacle platform will help us scale and optimize internal processes so that they keep pace with evolving consumer demands and market trends.

Discover Financial Services (DFS), is a direct bank in the United States. With presence across all 50 states, it is the 33rd largest bank holding company in the US. DFS is committed to becoming a truly digital bank, co-opting Finacle as a partner in this endeavor.

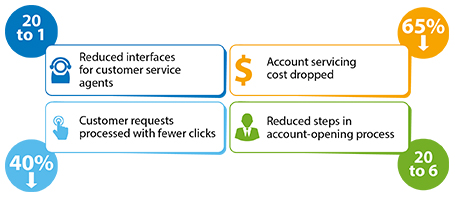

As a first step in that journey, DFS looked to replace its complex, legacy IT environment, which supported 100 discrete IT services, with 75 requiring point-to-point integration. Many of these services were also being used from hosted system providers. With pan-U.S. presence, compliance with multiple and constantly evolving federal and state laws was also a critical requirement. DFS selected a program with progressive renewal and modernization, minimizing risks and accelerating accrual of business benefits.

Case Study: ICICI Bank, India

Agility for continuous innovation and digital banking leadership

Ms. Chanda Kochhar, Managing Director & Chief Executive Officer, ICICI Bank

ICICI Bank has a rich legacy of leveraging the latest technology to bring in new paradigms in banking. Akin to pioneering new technologies in the country like software robotics, mobility and near-field communication among others, I am delighted that we are the first bank in India and among few globally to set up a blockchain application.

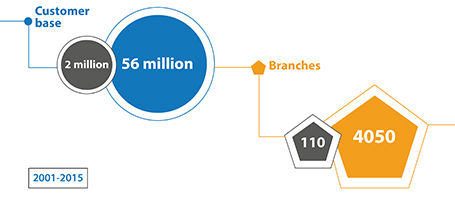

ICICI Bank, the largest private sector bank in India, is a pioneer in leveraging technology and adoption of digital banking, and in the process achieving explosive growth in customer base and business volume. Riding on the sound technology foundation and multichannel capabilities offered by Finacle Core Banking, and Finacle e-banking solutions, the bank has pioneered many industry-first innovations such as Flexi-fixed deposits, Goal based flexi-recurring deposits, Facebook Banking, Direct Banking, and Tablet Banking. The bank has also launched several other innovative offerings including -

- #icicibankpay, a service that allows users to transfer money, check account balances and transaction histories, and even recharge prepaid mobile plans, all through Twitter

- This was quickly followed by the launch of Pockets, India’s first digital wallet that enables users, including non-ICICI customers, to transact on any website or mobile application in the country.

- Only a few months later, it launched iWear, the country’s first multi-platform smartwatch app that lets its customers stay connected with their bank accounts at all times.

In October 2016, ICICI Bank launched a Blockchain network for international remittances and trade finance with Emirates NBD. This network was successfully piloted on the UAE-India remittance corridor, one of the busiest and biggest corridors in the world. With this, Emirates NBD became the first bank in UAE and ICICI Bank, the first bank in India, to pilot a blockchain-based network for financial services.